What States Have No Estate Or Inheritance Tax . States with estate taxes, inheritance taxes, or both. twelve states and washington, d.c. states that don't have estate or inheritance taxes. Here is what each state taxes and which ones. states with estate taxes. Most states have been moving away from estate or inheritance taxes or have raised their Many states levy an estate tax on top of the federal estate tax. massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $9.1 million. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. states with no inheritance or estate tax. However, keep in mind that. Maryland is the only state to impose both. states that won't tax your estate when you die. The states on this list have no death taxes.

from www.merceradvisors.com

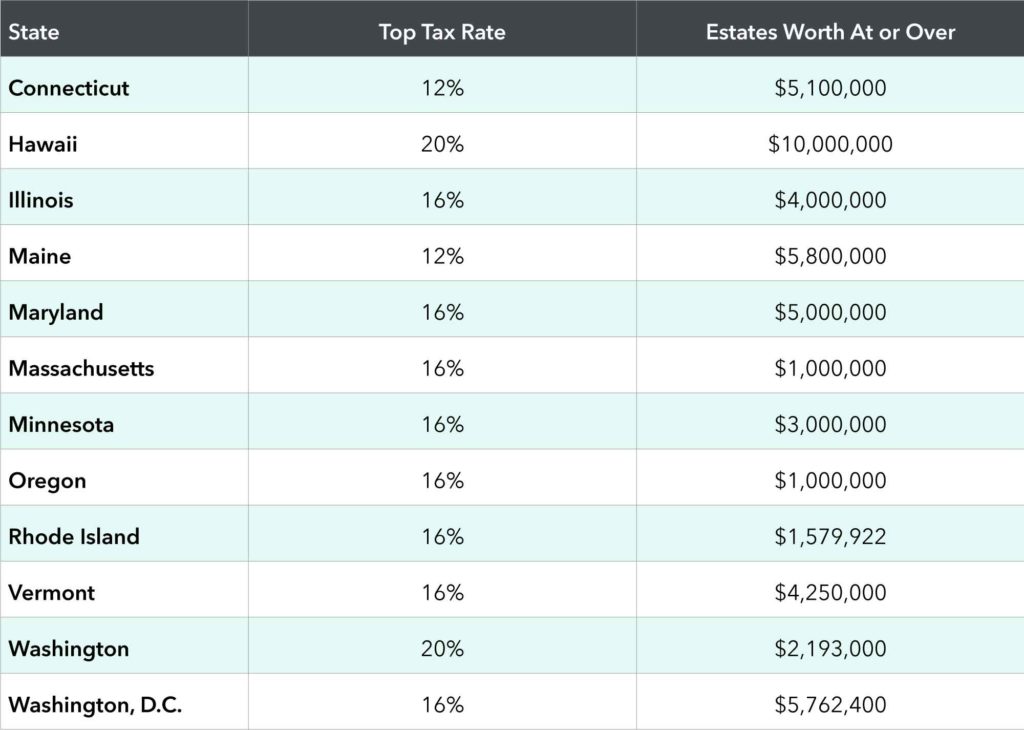

States with estate taxes, inheritance taxes, or both. Many states levy an estate tax on top of the federal estate tax. states with estate taxes. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. Impose estate taxes and six impose inheritance taxes. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. states that don't have estate or inheritance taxes. twelve states and washington, d.c. Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. Maryland is the only state to impose both.

Which States Have Inheritance Tax? Mercer Advisors

What States Have No Estate Or Inheritance Tax Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. Many states levy an estate tax on top of the federal estate tax. However, keep in mind that. Here is what each state taxes and which ones. twelve states and washington, d.c. states with estate taxes. Impose estate taxes and six impose inheritance taxes. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. states that don't have estate or inheritance taxes. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. states with no inheritance or estate tax. Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. Most states have been moving away from estate or inheritance taxes or have raised their Maryland is the only state to impose both. states that won't tax your estate when you die. The states on this list have no death taxes.

From rubenlijo.blogspot.com

does california have estate or inheritance tax Shanae Ocampo What States Have No Estate Or Inheritance Tax Maryland is the only state to impose both. Many states levy an estate tax on top of the federal estate tax. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $9.1 million. Impose. What States Have No Estate Or Inheritance Tax.

From wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax What States Have No Estate Or Inheritance Tax Here is what each state taxes and which ones. states that don't have estate or inheritance taxes. states with estate taxes. The states on this list have no death taxes. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. states with no inheritance or estate tax.. What States Have No Estate Or Inheritance Tax.

From www.financialsamurai.com

States With No Estate Tax Or Inheritance Tax Plan Where You Die What States Have No Estate Or Inheritance Tax Maryland is the only state to impose both. Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. twelve states and washington, d.c. Here is what each state taxes and which ones. states that won't tax your estate when you die. Most states have been moving away from estate or inheritance taxes. What States Have No Estate Or Inheritance Tax.

From taxfoundation.org

State Estate and Inheritance Taxes in 2014 What States Have No Estate Or Inheritance Tax Maryland is the only state to impose both. states with estate taxes. Many states levy an estate tax on top of the federal estate tax. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. However, keep in mind that. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent.. What States Have No Estate Or Inheritance Tax.

From anchorcapital.com

Moving States and Tax Residency Considerations Anchor Capital Advisors What States Have No Estate Or Inheritance Tax There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. states that won't tax your estate when you die. Many states levy an estate tax on top of the federal estate tax. Maryland is the only state to impose both. Most states have been moving away from estate or inheritance taxes or have. What States Have No Estate Or Inheritance Tax.

From www.taxpolicycenter.org

How do state estate and inheritance taxes work? Tax Policy Center What States Have No Estate Or Inheritance Tax states that don't have estate or inheritance taxes. twelve states and washington, d.c. states with estate taxes. Maryland is the only state to impose both. Here is what each state taxes and which ones. states with no inheritance or estate tax. Many states levy an estate tax on top of the federal estate tax. The states. What States Have No Estate Or Inheritance Tax.

From www.dontmesswithtaxes.com

17 states & D.C. collect an estate or inheritance tax Don't Mess With What States Have No Estate Or Inheritance Tax states with estate taxes. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. states that won't tax your estate when you die. twelve states and washington, d.c. States with estate taxes, inheritance taxes, or both. states. What States Have No Estate Or Inheritance Tax.

From taxfoundation.org

State Estate Tax Rates & State Inheritance Tax Rates Tax Foundation What States Have No Estate Or Inheritance Tax states that don't have estate or inheritance taxes. States with estate taxes, inheritance taxes, or both. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. However, keep in mind that. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. Impose estate taxes and six impose inheritance taxes. . What States Have No Estate Or Inheritance Tax.

From www.youtube.com

What States Have No Real Estate Tax? YouTube What States Have No Estate Or Inheritance Tax Most states have been moving away from estate or inheritance taxes or have raised their Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. states that don't have estate or inheritance taxes. Many states levy an estate tax on top of the federal estate tax. States with estate taxes, inheritance taxes, or both. There are. What States Have No Estate Or Inheritance Tax.

From philrep.com.ph

Real Estate 101 What is Inheritance Tax and Estate Tax? What’s the What States Have No Estate Or Inheritance Tax massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $9.1 million. states with estate taxes. states that don't have estate or inheritance taxes. Here is what each state taxes and which ones. There are 12 states that impose an estate tax in 2024, in addition to washington,. What States Have No Estate Or Inheritance Tax.

From www.thebalancemoney.com

3 Taxes That Can Affect Your Inheritance What States Have No Estate Or Inheritance Tax Maryland is the only state to impose both. Here is what each state taxes and which ones. twelve states and washington, d.c. The states on this list have no death taxes. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. There are 12 states that impose an estate. What States Have No Estate Or Inheritance Tax.

From policyandtaxationgroup.com

Countries With Or Without An Estate Or Inheritance Tax Policy and What States Have No Estate Or Inheritance Tax However, keep in mind that. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. Many states levy an estate tax on top of the federal estate tax. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. Of the six states with inheritance taxes, nebraska has the highest top rate. What States Have No Estate Or Inheritance Tax.

From thewealthywill.wordpress.com

Navigating Estate and Inheritance Taxes What You Need to Know by State What States Have No Estate Or Inheritance Tax twelve states and washington, d.c. Most states have been moving away from estate or inheritance taxes or have raised their States with estate taxes, inheritance taxes, or both. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. states that won't tax your estate when you die. However, keep in mind that. Maryland is the. What States Have No Estate Or Inheritance Tax.

From opportunitywa.org

Republicans propose state budget with no tax increases; more on capital What States Have No Estate Or Inheritance Tax Impose estate taxes and six impose inheritance taxes. Many states levy an estate tax on top of the federal estate tax. The states on this list have no death taxes. states with estate taxes. Maryland is the only state to impose both. Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. Maryland—which. What States Have No Estate Or Inheritance Tax.

From taxfoundation.org

Does Your State Have an Estate or Inheritance Tax? Tax Foundation What States Have No Estate Or Inheritance Tax states with estate taxes. states that don't have estate or inheritance taxes. states that have estate or inheritance taxes this leaves 17 states, plus the district of columbia, that still levy. Impose estate taxes and six impose inheritance taxes. twelve states and washington, d.c. states with no inheritance or estate tax. Most states have been. What States Have No Estate Or Inheritance Tax.

From www.realsimple.com

States With No Estate or Inheritance Taxes What States Have No Estate Or Inheritance Tax Maryland is the only state to impose both. Here is what each state taxes and which ones. Maryland—which also has an estate tax—imposes the lowest top rate at 10 percent. Impose estate taxes and six impose inheritance taxes. Many states levy an estate tax on top of the federal estate tax. twelve states and washington, d.c. Of the six. What States Have No Estate Or Inheritance Tax.

From www.investopedia.com

Inheritance Tax What It Is, How It's Calculated, and Who Pays It What States Have No Estate Or Inheritance Tax states with estate taxes. states with no inheritance or estate tax. Impose estate taxes and six impose inheritance taxes. twelve states and washington, d.c. States with estate taxes, inheritance taxes, or both. However, keep in mind that. Maryland is the only state to impose both. Here is what each state taxes and which ones. states that. What States Have No Estate Or Inheritance Tax.

From wisevoter.com

States With No Property Tax 2023 Wisevoter What States Have No Estate Or Inheritance Tax Impose estate taxes and six impose inheritance taxes. There are 12 states that impose an estate tax in 2024, in addition to washington, d.c. Most states have been moving away from estate or inheritance taxes or have raised their Here is what each state taxes and which ones. Many states levy an estate tax on top of the federal estate. What States Have No Estate Or Inheritance Tax.